Introduction to Student Loan Refinancing

Student loan refinancing is a strategic financial move that involves taking out a new loan to pay off one or more existing student loans. This new loan typically comes with a lower interest rate, which can lead to significant savings over the loan’s lifespan. Refinancing is a popular option for borrowers looking to reduce their monthly payments, pay less in interest over time, or simplify their finances by consolidating multiple loans into a single, more manageable payment.

The potential benefits of student loan refinancing are multifaceted. Securing a lower interest rate not only reduces the overall cost of the loan but also decreases monthly payments, thus providing immediate financial relief. For borrowers juggling several loans, refinancing offers the added advantage of consolidation, which streamlines the monthly repayment process and reduces the likelihood of missed payments.

Given the current economic conditions and the trend of historically low interest rates, now is an opportune time to consider refinancing student loans. Many lenders are offering competitive rates to attract borrowers, making it possible to lock in a better deal than what may have been available when the original loans were taken out. Additionally, as the financial landscape continues to evolve, refinancing now can provide protection against the possibility of rising interest rates in the future.

Eligibility Criteria for Refinancing

When looking to refinance your student loans, understanding the eligibility criteria is crucial. Lenders scrutinize several factors to determine your qualification. One of the primary elements considered is your credit score. Generally, most lenders require a good to excellent credit score. A higher credit score not only enhances your eligibility but can also result in more favorable interest rates. Typically, a minimum credit score in the range of 650 or higher is essential, although specifics may vary across lenders.

Income levels are another significant consideration. Lenders prefer borrowers who have a stable and sufficient income to ensure that they can comfortably manage loan repayments. Employment history plays a pivotal role in this assessment. A steady job with a reliable salary can significantly boost your refinancing application. Lenders usually look for a consistent employment record over a certain period, often around two years, in your current job or within your field.

The debt-to-income (DTI) ratio is equally important when assessing your eligibility. This ratio measures your total monthly debt payments against your gross monthly income. A lower DTI ratio suggests good financial health and an ability to manage monthly payments effectively. Lenders typically favour applicants with a DTI ratio of 50% or lower; however, requirements can differ among various financial institutions.

It is also worth noting that some lenders may consider additional factors such as your educational background or the institution you attended. Graduates from certain accredited universities or specific programs can sometimes benefit from more lenient criteria or preferential rates.

Each lender has its unique set of eligibility prerequisites, meaning there isn’t a one-size-fits-all approach. Therefore, it is advisable to research and compare various lenders to determine which one aligns best with your financial circumstances and refinancing goals. By meeting or exceeding the typical eligibility criteria, you increase your chances of securing a refinancing deal that can save you thousands over the life of your student loans.

Types of Student Loans That Can Be Refinanced

When contemplating the refinancing of student loans, it is crucial to understand the distinct differences between federal and private student loans. Both types can be refinanced; however, the benefits, considerations, and impacts of refinancing might vary significantly.

Federal student loans are those issued by the government, often distinguished by their favorable terms and borrower protections. These loans typically offer income-driven repayment plans, potential eligibility for loan forgiveness programs, and deferment or forbearance options during financial hardships. However, when refinancing federal loans through a private lender, borrowers give up these protections and options. Therefore, it is essential to carefully evaluate whether the benefits of a potentially lower interest rate outweigh the loss of these federal benefits.

On the other hand, private student loans are issued by banks, credit unions, and other private lenders. These loans generally come with higher interest rates compared to federal loans and do not offer the same borrower protections. Refinancing private student loans typically presents fewer risks since there are no federal benefits to lose. Refinancing can lead to a lower interest rate, a reduced monthly payment, or a shorter loan term, thereby potentially saving thousands of dollars over the life of the loan.

Regardless of the type, borrowers should consider their current financial situation, the loan terms offered by the new lender, and their future financial outlook when deciding to refinance. A comprehensive review of the potential savings against the benefits forfeited is paramount. For instance, those with stable incomes and good credit may find refinancing beneficial, while those relying on income-driven repayment plans or considering career paths that offer loan forgiveness might prefer to retain their federal loans.

In conclusion, both federal and private student loans can be refinanced, but the approach and individual benefits may differ. Understanding the nuances of each type of loan ensures informed decision-making and maximizes financial benefits.

Steps to Refinance Your Student Loans

Refinancing your student loans can potentially save you thousands of dollars over the life of your loan. To achieve this, it is essential to follow a structured approach. Here are the key steps to help you through the process:

The first step in refinancing student loans is to check your credit scores. Your credit score significantly impacts the interest rates and terms you will be offered. Many lenders require a minimum credit score, typically around 650 or higher, to qualify for refinancing. You can obtain your credit score from various online services or directly from credit bureaus.

Next, research and compare different lenders. To ensure you get the best deal, it’s necessary to shop around and evaluate offers from multiple financial institutions. Look for lenders with competitive interest rates, favorable repayment terms, and excellent customer service. Online comparison tools can be very useful during this stage.

Once you identify potential lenders, the next step is to prequalify for loan offers. Prequalification is a process where lenders provide you with estimated interest rates and terms based on a preliminary assessment of your financial profile. It involves a soft credit check, which does not affect your credit score. Prequalification allows you to understand your refinancing options without committing to a particular lender immediately.

Gathering the necessary documentation is the next crucial step. Different lenders have varying requirements, but generally, you will need your identification, proof of income, loan statements, and potentially your credit history reports. Having all required documentation ready can streamline the application process.

Finally, submit a formal application to the lender that best meets your refinancing needs. This step usually involves a hard credit inquiry, which may have a slight impact on your credit score. Ensure that all information provided is accurate and complete to avoid delays in approval.

Throughout this entire process, the importance of shopping around cannot be overstated. By comparing various options and securing the most favorable terms, you can significantly reduce your overall loan costs.

“`html

How to Compare Student Loan Refinancing Offers

When considering refinancing your student loans, it’s essential to understand how to compare various refinancing offers. The primary factors to examine include interest rates, repayment terms, fees, and potential penalties for early repayment. By carefully evaluating these elements, you can choose an option that best suits your financial situation and goals.

Interest rates are a critical aspect of any loan offer. Refinancing loans typically come with either fixed or variable interest rates. Fixed rates remain the same over the life of the loan, providing stability in monthly payments. In contrast, variable rates can fluctuate based on market conditions, which might result in lower initial payments but could lead to higher costs over time. When comparing interest rates, ensure you understand the differences between these two types and how they align with your financial risk tolerance.

Repayment terms are another key factor. Long-term loans often come with lower monthly payments but higher overall interest costs, while short-term loans usually have higher monthly payments but lower total interest payments. Assess your financial capacity to determine which repayment duration fits your situation.

Fees associated with refinancing should not be overlooked. These can include origination fees, application fees, and any administrative costs. Comparing these fees across different lenders can help you find the most cost-effective option. Furthermore, some lenders may charge prepayment penalties, which are fees for paying off your loan early. Evaluating these potential penalties is crucial, especially if you plan to pay off your loan faster than the agreed term.

To make an informed decision, consider utilizing online comparison tools offering detailed loan analysis and lender reviews. Additionally, consulting with financial advisors can provide personalized insights and professional advice tailored to your financial profile.

By systematically comparing interest rates, repayment terms, fees, and penalties, you can secure a refinancing offer that maximizes your savings and aligns with your long-term financial objectives.

“““html

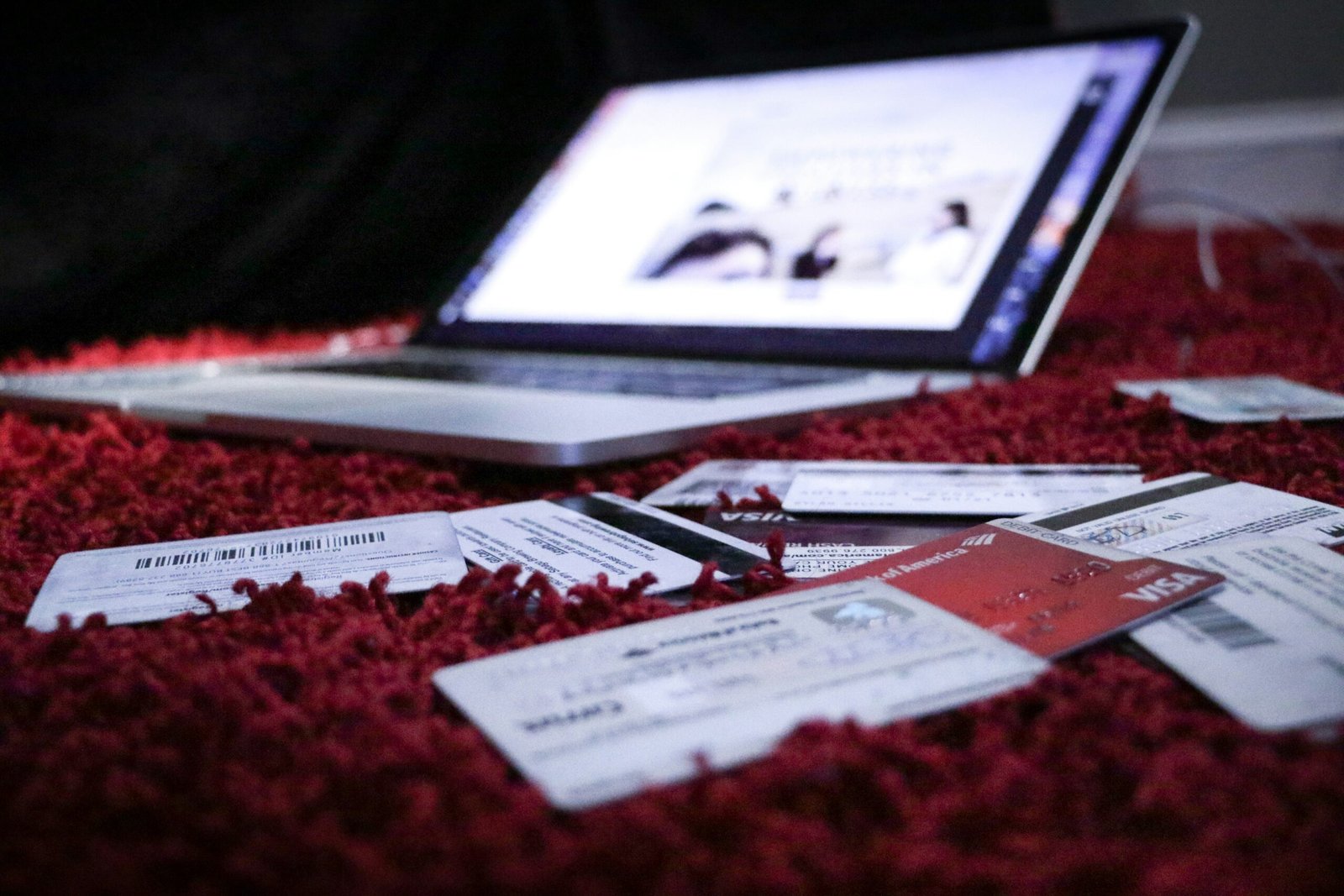

Potential Pitfalls and Risks of Refinancing

Refinancing student loans can present several risks that borrowers must carefully consider. One primary concern is the loss of federal loan benefits. Federal student loans offer a range of protections and options that private lenders typically do not, such as income-driven repayment plans. These plans adjust monthly payments based on your income and family size, providing essential flexibility for borrowers facing financial difficulties.

Another critical federal benefit is eligibility for loan forgiveness programs. For instance, the Public Service Loan Forgiveness (PSLF) program forgives the remaining balance on your federal student loans after you make 120 qualifying monthly payments while working full-time for a qualifying employer. Refinancing federal loans into private loans will render borrowers ineligible for these programs, potentially costing them significant savings in the long run.

Additionally, potential fees associated with refinancing can detract from the perceived financial benefits. While some lenders boast “no fee” refinancing, others may charge application fees, origination fees, or prepayment penalties. It’s imperative to read the fine print and factor these costs into your savings calculations to ensure that the refinancing will genuinely result in financial gain.

The impact of refinancing on credit scores is another aspect to consider. Applying for a refinancing loan typically involves a hard credit inquiry, which can temporarily lower your credit score. Should you decide to apply with multiple lenders to find the best refinancing rate, each inquiry could compound this effect. Maintaining a strong credit score is crucial, as it influences other aspects of financial health, such as your ability to secure favorable interest rates on future loans or credit products.

In light of these potential pitfalls, it is crucial for borrowers to weigh the risks of refinancing against the potential savings meticulously. Refinancing can offer significant financial benefits, but only when approached with a clear understanding of both the advantages and the potential drawbacks. Careful planning and consideration will ensure that you make an informed decision that aligns with your long-term financial goals.

“`

Success Stories and Case Studies

Refinancing student loans can lead to significant financial savings and numerous other benefits. Consider the case of Sarah, a recent graduate burdened with $50,000 in student loans at an interest rate of 6.8%. Through diligent research, Sarah refinanced her loans, securing an interest rate of 4.5% over a 10-year term. This critical decision translated into saving more than $15,000 in total interest payments. The reduction in monthly payments also provided Sarah with greater financial flexibility, allowing her to invest in her career and personal life more confidently.

Similarly, Michael, a medical school graduate, faced a staggering $200,000 in student loan debt with an average interest rate of 7%. By opting to refinance his loans, Michael obtained a fixed interest rate of 4.75% on a 15-year term. The refinancing not only trimmed down his monthly payments but also resulted in substantial interest savings of approximately $45,000 over the loan’s life. One of the most compelling success stories is that of David, an MBA graduate with multiple student loans totaling $130,000 at an average rate of 6.5%. A savvy financial move enabled David to refinance his loans, securing a 4% interest rate for 12 years. David’s refinancing strategy helped him save almost $28,000 in interest. The consolidation of multiple loans into one reduced his administrative burden and provided a clearer path toward financial stability.These examples highlight the tangible benefits of student loan refinancing. They underscore the transformative potential it holds for graduates carrying burdensome educational debts. By understanding their initial loan conditions, securing better terms through refinancing, and effectively managing their financial resources, individuals like Sarah, Michael, and David have successfully carved out more prosperous futures. Their stories serve as powerful motivators, illustrating the significant savings and financial liberation possible through strategic refinancing.

Conclusion and Next Steps

In summary, refinancing your student loans can offer significant financial relief by potentially lowering interest rates and reducing monthly payments. This adjustment not only makes debt management more manageable but also frees up funds for other financial goals. As detailed earlier, refinancing essentially involves taking out a new loan to pay off existing student loans, ideally under more favorable terms. The critical steps discussed included understanding the benefits and potential drawbacks, assessing different lenders, evaluating the terms and conditions, and considering your long-term financial plans.

Before embarking on the refinancing journey, it is crucial to carry out thorough research. It’s recommended to compare offers from various lenders to see which one best suits your needs. Since refinancing is not a one-size-fits-all solution, it’s vital to scrutinize each offer meticulously to understand the implications fully. Readers must be aware that while federal loans offer certain protections and repayment benefits, they may be lost upon refinancing with a private lender, making it pertinent to weigh these trade-offs.

If you believe refinancing is the right step, your next actions are clear. Start by checking your eligibility, as specific credit scores and employment criteria must typically be met. Next, gather all necessary documentation, such as proof of income, credit history, and identification details. Having these documents ready will streamline the process and enable you to respond promptly to any lender inquiries. Furthermore, begin exploring various refinancing options available to you today. Use online calculators to get a rough estimate of new payment structures, and don’t hesitate to consult financial advisors if needed.

Taking these steps can set you on a path to not only save thousands over the life of your loans but also achieve greater financial flexibility and security. By staying informed and proactive, you can make impactful decisions that bring you closer to your financial goals.